Building and securing a cryptocurrency portfolio can be a complex process, but with the right approach, it can lead to significant rewards. In this article, we’ll discuss tips and strategies to help you create and maintain a robust, secure, and diverse cryptocurrency portfolio.

- Research and Due Diligence

Before investing in any cryptocurrency, it’s essential to conduct thorough research on the project, its technology, team, and potential for growth. Consider the following factors when evaluating a cryptocurrency:

- Market capitalization: A higher market cap often indicates a more established and stable project.

- Technology: Evaluate the blockchain’s technology, consensus mechanism, scalability, and security.

- Team: Look for experienced and reputable team members with a proven track record.

- Community: A strong and active community can provide support and drive adoption.

- Diversification

To minimize risk and maximize potential returns, diversify your portfolio by investing in a mix of cryptocurrencies, including:

- Large-cap coins (e.g., Bitcoin, Ethereum) with established track records and market dominance.

- Mid-cap coins with potential for growth and a solid technology foundation.

- Small-cap coins and tokens with higher risk but also higher potential returns.

- Investment Strategies

Consider implementing the following investment strategies to optimize your portfolio:

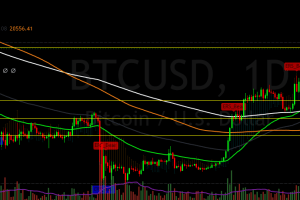

- Dollar-cost averaging: Invest a fixed amount regularly (e.g., monthly) to reduce the impact of market volatility.

- Long-term holding: Focus on long-term growth by holding your investments for an extended period.

- Trading: Actively trade cryptocurrencies to take advantage of short-term price fluctuations.

- Security Measures

Protecting your cryptocurrency investments is crucial to maintaining a secure portfolio. Implement these security measures to safeguard your assets:

- Use hardware wallets: Store your cryptocurrencies in a hardware wallet, such as Ledger or Trezor, for maximum security.

- Enable two-factor authentication (2FA): Use 2FA on all exchanges and wallets to add an extra layer of protection.

- Be cautious with ICOs and new projects: Avoid investing in projects without proper research to minimize the risk of scams and fraud.

- Portfolio Management Tools

Utilize portfolio management tools to track your investments, monitor performance, and make informed decisions. Popular cryptocurrency portfolio trackers include:

- CoinMarketCap

- Delta

- Blockfolio

- Tax Compliance

Understanding and complying with cryptocurrency tax regulations is essential. Consult a tax professional or use tax software like CoinTracker or CryptoTrader.Tax to ensure you’re adhering to local tax laws.

Conclusion

Building and securing a cryptocurrency portfolio requires research, diversification, strategic investment, and robust security measures. By following these tips and strategies, you can optimize your portfolio for growth while minimizing risk. Remember to stay informed about market trends and regulatory changes to ensure your investments remain secure and compliant.

![StarsArena (StarShares): The Universe of Web3 Crypto Social Media! [Guide] starsarena](https://cryptos.us/wp-content/uploads/2023/10/starsarena.png)